The Madison-Marine-Homecrest Civic Association (MMHCA) held its final monthly meeting until September on June 15th at the Carmine Carro Community Center in Marine Park, with a tax expert as the guest speaker.

Two new 61st Precinct Neighborhood Coordination Officers (NCOs) were introduced at the start of the event, Loobans Jolicoeur of Sector B and Esgar Osorio of Sector C. The new officers greeted the audience, gave brief updates on crime and encouraged the community to attend the next Build the Block meetings.

Forty-five abandoned cars and trailers were towed last month during the regular tow operation, helping clear up some parking for residents.

MMHCA Civic President Elizabeth Morrissey also addressed the repaving of the Marine Park tracks and tree prunings currently underway. It began at the start of the month and does not yet have an announced completion date.

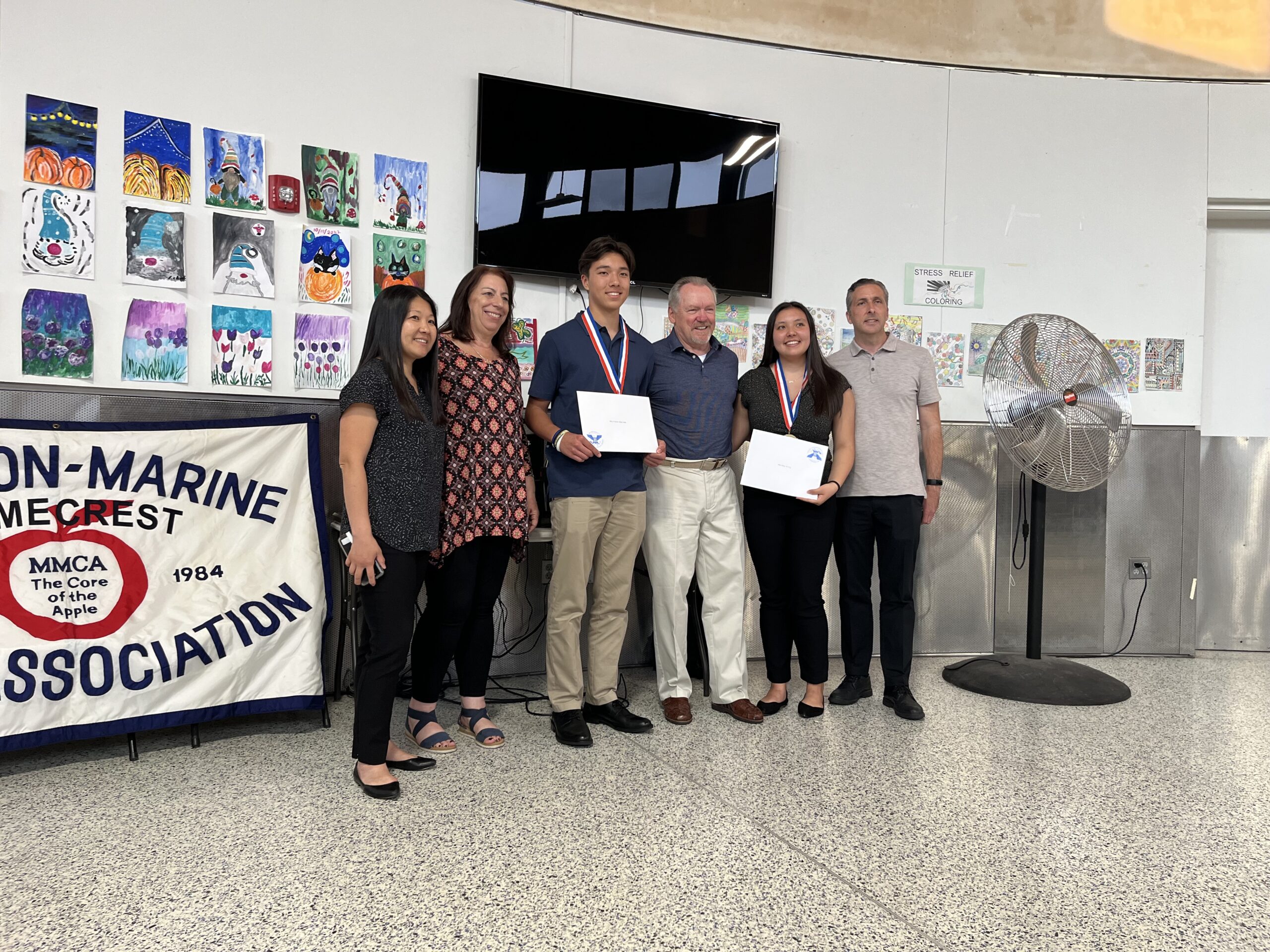

The Marine Park Alliance and the Mary Powell Foundation also held a quick awards ceremony for two local teens who recently won the President’s Volunteer Service Award. Ellie and Matthew Krumm each earned the gold level of the award, which is the highest distinction offered aside from lifetime achievement. Matthew completed 157 hours of volunteering, while his sister finished 273 hours of service.

“I congratulate you on taking it upon yourself to contribute to the public good,” foundation Chairman Richard Powell said while presenting the awards. “Throughout our country’s history, the American story has been strengthened by those who combined an optimism about what can be with the resilience to turn that vision into reality. I know I’m not alone in recognizing that those who are willing to step up and volunteer in service of community and country are essential to the ongoing work of forming our more perfect union.”

Following the awards presentation was a workshop on understanding common tax questions. The workshop was led by a representative of JTH Tax Planning, an accounting firm in Marine Park.

The Internal Revenue Service is considering increasing the capital gains rate on stocks and reassessing the tax rate associated with 401K retirement plans, he explained.

“[The IRS is] hiring 87,000 agents,” the accountant said. “And who are those agents gonna go after? The retirees. Because who has some money? The retirees.”

Another important thing to know is that there are tax exemptions if you’re selling your primary residence instead of putting it in your family’s inheritance.

When you sell a home for more than you purchased it for, you make money off the sale. Those profits are called capital gains and they can be taxed by the IRS. However, a portion of the gains are exempt from taxes. If you’re single, you get a $250,000 exemption and if you’re married, you get a $500,000 exemption.

Before selling, you’ll also want to hire an accountant to do a basis evaluation on the home. During this evaluation, they’ll take a look at all of the renovations you’ve done to the home since becoming its owner — every repaint, every new window panel installed and every room that’s been overhauled.

The accountant will then calculate a total amount of money spent on renovating the house and that number can be subtracted from the capital gains — the resulting number being the amount of profit you have to pay taxes on. The rest of the money you get to keep tax-free.

Overall, the speaker urged people who are looking to sell their homes to reach out to the firm for more personalized guidance. JTH Tax Planning is located at 2941 Avenue S.